It’s generally accepted that it’s tough to beat the performance of low-cost, index-tracking ETFs. After fees, most actively managed professional funds don’t beat the indices over the long haul. While we can get lucky from time to time, most DIY investors can’t beat the indices either. We can however, have our heads turned by an attractive income stream. High yield ETFs have found new life since the covid lockdown. The whole work from home thing had many of us wanting to carry on working from home forever. If we could figure out how to get our investment portfolios paying as much as our day job, we could call it quits & be totally done with working for a living, eh?

Traditionally, you could build an income stream with a portfolio of dividend stocks or with some dividend yielding ETFs. Covered call writing can boost the distribution of an ETF beyond the dividends of the holdings. For investors who need an income stream, it’s an attractive proposition. You get a bigger income stream, without the hassle of selling shares for income. And you might not have to worry about selling shares in a down market. The negative thing about it is that you often lop off some of the upside with a covered call strategy. Selling a call means that you’ve made a few extra bucks, but you now have a contract to sell your shares at an agreed price. If the stock goes beyond that strike price, your shares are called away & the option buyer gets to buy them at a lower price than they are then worth. You’ve lost some of the upside. In general, these covered call ETFs will underperform an ETF that just holds the same stocks for growth. But so long as the underlying value of the covered call portfolio continues to grow, some people are okay with that. Instead of paying a financial advisor to give you a monthly cheque, you’re just letting the ETF manager use some of the upside to pay for the service. Some think that a covered call ETF will protect them when the market drops. That’s often not true. Other than the extra option premium we get, these ETFs can crash every bit as far & as fast as a regular ETF holding the same stocks. In general, covered call ETFs are more likely to underperform over the long haul. Though some are better than others, so you do need to compare before taking the plunge.

Fund managers are good business people. They know a good opportunity when they see it. They watched the enthusiasm for covered call ETFs growing & they realised that they could make it more appealing with the even bigger income stream that is available through the use of leverage. Leverage is borrowing money to invest in more shares. While borrowing cash for stocks can be an intimidating proposition for an individual, it’s a lot easier if the fund manager does all that for you inside the ETF. You can now find many ETFs advertising the enhanced yield that comes from using modest leverage. Those are marketing words with a lot of allure. Who doesn’t want “enhanced” yield? And nobody should fear “modest” leverage, right? You can see the appeal of the marketing message, eh?

But how well does this combined approach work?

The covered call bit is pretty straightforward, but let’s look at the effects of leverage. Since many of the new funds are too new to have any worthwhile history to examine, let’s start with a Canadian index fund instead. Canadians love Blackrock’s iShares S&P/TSX 60 Index ETF, XIU. If you invested $10k in XIU back at the start of January 2000, with all dividends reinvested, you’d be sitting of a portfolio worth $47,757.00 today. If Grandma had loaned you enough money, at a zero percent interest rate, to apply a 25% leverage ratio to your investment, you would have $65,269.00 today.

Oh yeah, baby! Gotta love that leverage thing, eh!

Now what if Grandma had offered to loan you the leverage money at a 7.2% interest rate? Would you have taken her up on it?

If you had, your portfolio would be worth only $42,487.00 today. That’s a lower return than just investing in XIU without leverage. I think Grandma suckered you! I cheated a bit here to make a point. That 7.2% is the current prime lending rate. Interest rates were lower for much of that time & you’d have fared better with lower cost leverage. But if you were to get your own leverage by applying margin within your brokerage account, you might pay even more today. Check the margin rates at your brokerage. Fund & ETF managers can get better rates than we can, of course, but their fund returns will be negatively impacted by higher interest rates too. It all adds to the costs involved with managing these funds. These numbers won’t be on the front page of the ETF brochure. You’ll often have to dig into the multi-page downloadable documents (prospectus & financial statements) to see what these costs are. You’ll also find the TER (Trading Expense Ratio) here. I know, I know, I hate that small print stuff too. But once you dig, & with today’s higher rates, it’s not difficult to find a fund like this with a real total expense ratio of 2% or more. Let’s be real, the size of the fee doesn’t matter if the performance is good enough to pay for it. But if it’s not, we might do better with an advisor charging 1% to put us into low cost index funds & letting them do all the work to make sure we have an income stream every month. I’ve taken some liberties with this simple example here, but what’s the takeaway?

Going into one of these ETFs can be a bit like putting a donkey into a horse race. Generally, the low-cost index funds are the race horses. Active management adds more cost & doesn’t always add more return. Adding a covered call strategy is like putting bricks on the back of the donkey. They slow our ass down! Adding leverage is like using helium balloons to compensate for the drag of the load of bricks. How well a fund manager balances the bricks & the balloons over time will determine the fate of the investment. As will the fees charged for doing all that work. Interest rates have an impact too. The value of leverage goes down when interest rates go up. And leverage increases volatility. When the underlying investment goes up, leverage will make it go up further. When it goes down, leverage makes it go down further. The investor’s ability to handle that volatility is important too. It’s no surprise that leverage works best with assets that show consistent growth in a low interest rate environment. Check the history of total return when comparing one of these high yielding ETFs against a simple equity ETF. New funds lack history & it’s nice to see if a fund has proven itself over time. And during different market conditions. While past performance does not predict future results, it’s always worth taking a look at past performance before you place a bet with your retirement money.

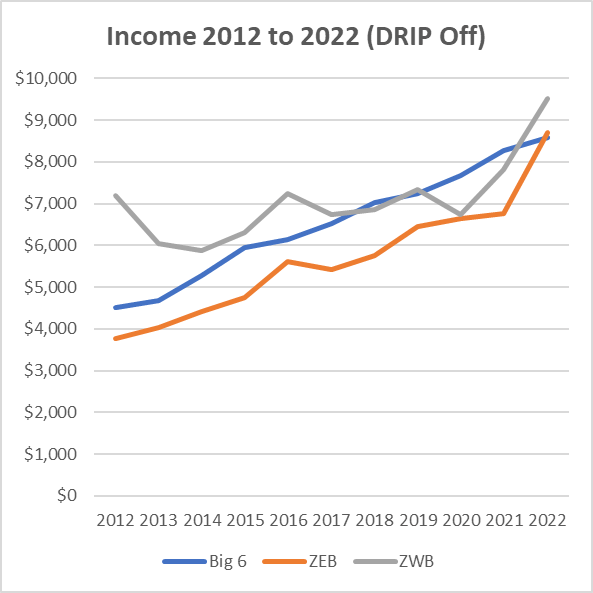

Doing this comparison is even more critical if all the distributions are being pulled out for living expenses. A fund that consistently declines in asset value, as distributions are removed, is far more likely to provide a declining income stream over time. Try out the tools at Portfolio Visualizer for these comparisons. It gives a great snapshot of performance differences between funds. And it can show the history of the income stream. A declining income stream over time might not work well for an early retiree with a long time horizon.

While index investing is often recommended for investors with a long time horizon, there is an undeniable attraction to a nice income stream at any age & stage of the investing journey. But, starting out, be a little careful about how much of your portfolio is allocated to high-yield funds. Having great underlying holdings isn’t always enough. That does not mean that these funds don’t have a place in some portfolios. Just be careful with your choices!

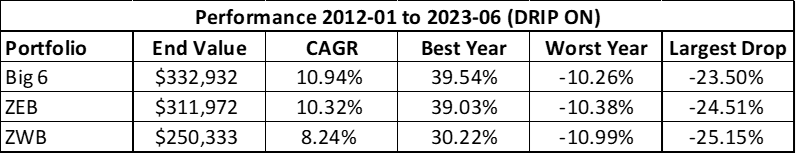

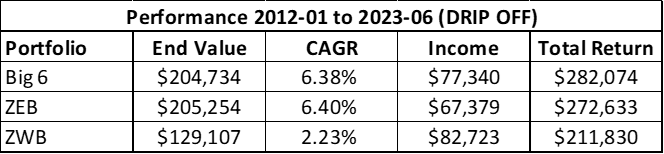

There is another post on Canadian Banks for Dividend or Covered Call Income? if you want to read more on a comparison of the covered call approach.

If you want to learn more about all this from the ground up, I’d like to suggest that you check out Double Double Your Money, available at your local Amazon store.

Important – this is not investing, tax or legal advice, it is for entertainment & educational purposes only. Opinions are my own, so do your own due diligence & seek professional advice before investing your money.