Happy New Year to all & here’s to our collective success in beating the market this year. Of course, we can’t all beat the market, we need some losers to lose money so we can be winners. But in the best tradition of reading great free advice on the internet, let me tell you that while beating the market is a big deal, it’s not that hard to do.

(Make sure you don’t stop at the first chart, there is a twist to this tale! 😜)

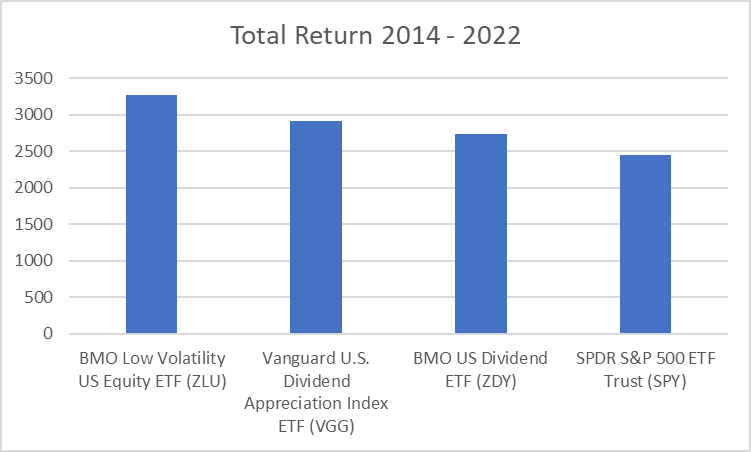

If you’d stuck a thousand bucks into these three ETFs back at the end of 2013, & reinvested the dividends along the way, you’d have beaten “the market” with any of them. Check out the chart below, the two BMO ETFs & the Vanguard Canada ETF all beat the American index tracker. Seems like a no-brainer, eh?

Of course, making a decision from this one chart would not be wise. And you’re seeing it on the internet, for cryin’ out loud! Instead, we’d have to do our due diligence, eh? Maybe read the marketing blurb on the fund’s website. Find a few online buddies that have invested in it & that want you to invest in it too. Ignorance, like misery, loves company. That is not doing due diligence!

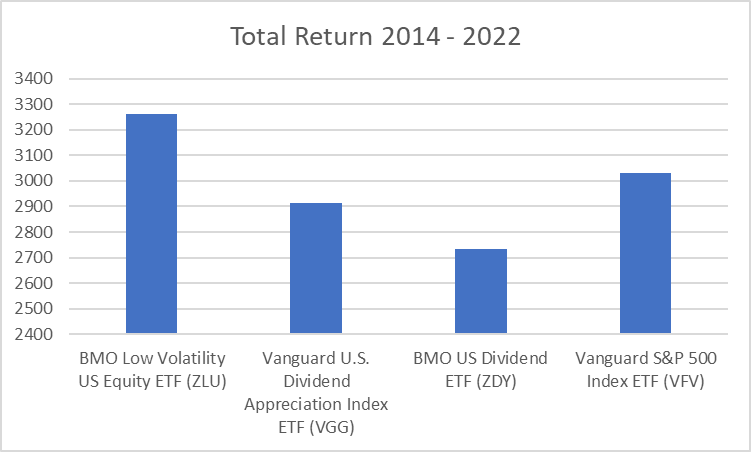

Now look at that same chart but, this time, with Vanguard’s VFV replacing SPY & you get this …

What’s going on here? Both SPY & VFV track the same index. Yet VFV is doing way better. It’s because we were comparing red apples to green apples in the first chart. SPY is in US dollars. Back at the start of this comparison, the Canadian dollar was strong for the first couple of years. The original investment in SPY was in US$, while the original investment in VFV was in Can$. As the Canadian dollar weakened over the years, VFV benefitted from holding US stocks, priced in US dollars. VFV is getting a numeric advantage because one US dollar is buying more loonies today. That makes VFV’s numbers bigger. But the benefit is only in the numbers, not in the value when compared to the current exchange rate. In fact, SPY would do a little better because of its lower fee structure. However, for a Canadian investor to buy SPY, there would be a currency exchange cost to consider too.

Only ZLU beat the index in both cases, so just buy that one, right? No, it’s not that simple. While all these ETFs are good, they only work as part of an overall investing strategy. They each hold differing numbers of stocks, with different sector exposures. They have different yields & costs. They are all focused on US stocks. Are they cheap or expensive relative to history & expectations? Besides, who knows what happens going forward. And 9 years is not a long time in investing cycles.

Which of these you choose for part of your portfolio depends on your investing philosophy. If you don’t have a personal investing philosophy, it’ll be tougher to build an investing strategy that will work with your fears & needs. This will be different for everyone. But once you know who you are as an investor, & what you are trying to achieve, you will find it easier to invest in things that might have a better chance of delivering for you. And, sometimes, that might mean we don’t need everything we hold to beat the market all the time.

This year, as with all prior years for a long time now, my new year’s resolutions include losing weight, exercising, & saving more.

Along with developing an investing philosophy that I’m comfortable with! 😜

Best of luck for 2023. I hope it’s a good one for all of us.