If I lived in the US, I would probably split my US exposure between the Schwab US Dividend Equity ETF (SCHD) & the Vanguard Dividend Appreciation Index Fund ETF (VIG).

Why?

For a few reasons. The first is because I like dividend-growth stocks & both those ETFs focus on companies that have the potential to create a growing income stream. Dividend-growth companies appear to hold up better than growth stocks when the markets crash. Because I’m a bit of a chicken, I tend to I favour ETFs with lower volatility than the market. The goal of choosing lower volatility investments is to take away some of the market downside when bad things happen. When a conservative investor seeks to avoid volatility, what we really mean is that we don’t want our stuff to go down. We don’t mind volatility to the upside, of course! But lower volatility ETFs usually knock off some of the highs too. These two ETFs, however, are great performers. One slightly lags the market, while the other has a slight beat. Both provide that level of performance with less volatility than an S&P 500 Index® ETF. Since 2012, they had better annual performance than the market in the worst years & their biggest drawdowns were less severe than those of the market too. The bottom line is they have provided good performance over time. And they offer the potential for reduced anxiety during the bad times. My kind of investing.

While we can buy these ETFs in Canada, there are pros & cons to a Canadian investing through the US exchanges. Some combination of laziness, currency exchange costs, & a desire to avoid additional tax reporting headaches has many Canadian investors favouring Canadian-listed ETFs for their American exposure. Can we do that & get the results provided by ETFs like SCHD & VIG. Let’s take a look.

There are ETFs from all the big providers, like Blackrock®, BMO Global Asset Management, Vanguard Canada, Horizons & others, that provide US market exposure solutions for Canadians. In Canadian dollars. An easy choice for one of the contenders is the Vanguard US Dividend Appreciation Index ETF (VGG). This one is easy because it holds just VIG, the very same US ETF mentioned above. Of course, the expense ratio (fee) is higher in Canada, but we’re used to that, eh! I would like a Canadian-listed equivalent to SCHD, but there really isn’t anything doing exactly what SCHD does up here. BMO’s ZDY is vaguely similar but the BMO Low Volatility US Equity ETF (ZLU) looks interesting too. With all the online chatter about high yield ETFs in recent years, I had to include one of those for comparison & I went with the BMO US High Dividend Covered Call ETF (ZWH). I think this is one of the better ones in this space & it merits inclusion to see if all the talk about the downside protection that this strategy offers is really true.

Let’s cut to the chase …

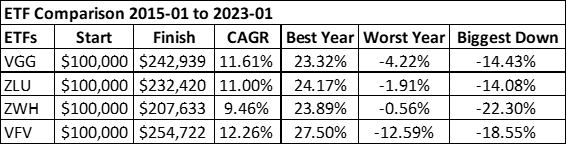

For the market benchmark comparison, I’m using Vanguard Canada’s S&P 500 Index® ETF (VFV). With everything in Canadian dollars, the variable exchange rate noise doesn’t confuse the comparison. Here we see the results of 100k invested in each of the ETFs at the start of 2015. ZWH was launched in 2014 so the data (courtesy of portfoliovisualiser.com) for this comparison starts in 2015.

What do you think of those results?

As is often the case, the low-cost market index fund wins out for total return. Over a long lifetime of investing, that 1.26% difference between the annual returns from ZLU & VFV, for example, could be huge. If you can tolerate the volatility, Mr. Buffett’s advice is looking good, the low-cost market index fund is the winner. But for more fearful investors, the lower volatility choices might help keep them in the market during times of steep decline. Jumping in & out of the market in response to market fluctuations can be a wealth killer for investors. For that reason, my choices would be VGG & ZLU in this instance. They don’t come as close to market returns as the two American ETFs we looked at earlier. But they’re good enough for me & I think I’d manage a better night’s sleep with those in my portfolio. I must be honest here, I was taken aback by how well ZLU has performed over the past 8 years. Can it sustain this level of performance? I have absolutely no idea. But I am impressed. ZWH was also surprisingly good. Though it shows the best “Worst Year” performance of the four, it had the biggest drawdown of the group, at 22.3%. That would have been a heart-stopper for me. Yet it managed to recover from that big drawdown to post pretty decent results over time. That’s a good outcome. Its total return over the period, however, lags the other two, so I would probably choose those instead. In retirement, when an income stream might be more important, ZWH might earn a place in a portfolio for some.

There’s a lot more under the hood here. Along with deciding on a US portfolio allocation percentage, an investor should consider the diversity of each fund for that US exposure. There are tax implications for US-listed vs Canadian-listed American equities in different accounts, sheltered & not. And so on. This post isn’t about any of that, it’s just an example of tailoring a portfolio to suit an investor profile that might be more, or less, risk tolerant.

What do you do for your US exposure?

And be sure to let me know if you have a suggestion for a better alternative than those above.

Important – this is not investing, tax or legal advice, it is for entertainment & educational purposes only. Opinion are my own, do your own due diligence & seek professional advice before investing your money.