The big guy delivered some good days leading into the holiday. But even without the little Santa Claus rally at the end, 2025 was a great year for investors. Globally diversified investors were finally rewarded for investing outside the US markets. This time last year, who would have guessed that the Canadian market would have topped the performance charts?

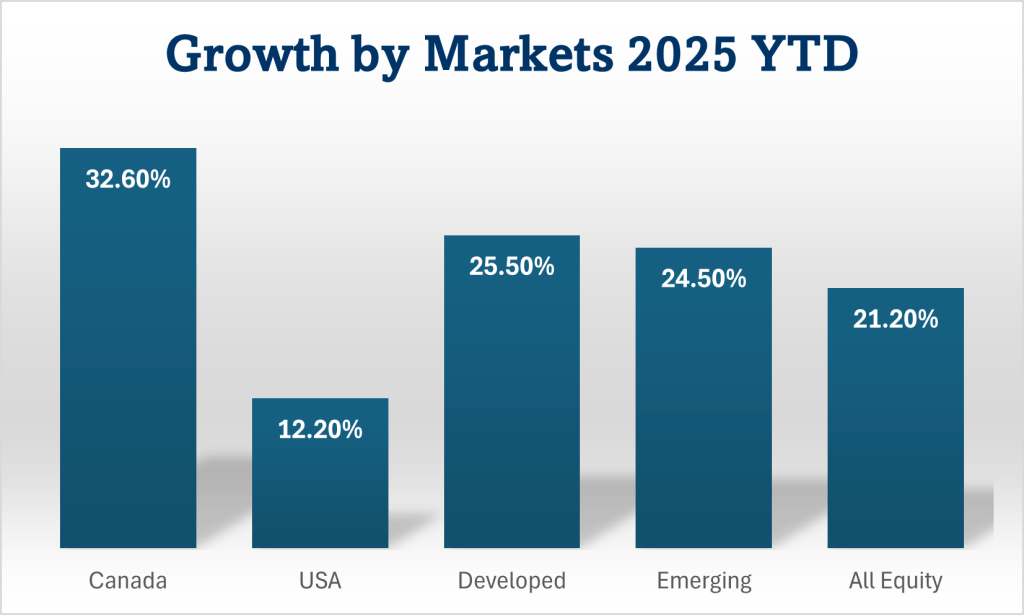

Here’s what market performances around the world were like up to now in 2025 …

This chart is built by comparing popular broad market ETFs that trade in Toronto. All dividends & distributions are reinvested to maximise total return. The last column is one of the popular all-equity ETFs that are globally diversified. It hold chunks of all the other columns in this chart, with a serious overweight to the world’s biggest market, the US. And the Canadian market is also overweighted, especially compared to its size. Because we all love a bit of home country bias, eh! The US market has outperformed in recent years. Starting out, I would not have guessed that 2025 was going to be the year where it lagged. And it would have been an even bigger stretch to imagine that Canada was going to come out on top. As usual, the pundits & talking heads are all over which markets are going to do well next year. Is it possible they only get it right accidentally!?!

My prediction for 2026 is that I’ll probably be better off if I put any spare couch-cushion-cash I find into one of the all-in-one ETFs that matches my asset allocation goals. Of course, I am prone to thinking I know better from time to time. And while I can occasionally get lucky, I mostly screw up when doing my own stock, sector, or market picking! 🤪

Thank you for joining me here throughout the year, I guess we’re all done for 2025. And here’s hoping the world is a nicer, kinder place in 2026.

May whatever light that lights your way shine ever brighter this holiday & beyond!

Best wishes,

Paul

If you want to learn more about saving & investing, please check out Double Double Your Money, available at your local Amazon store.

Important – this is not investing, tax or legal advice, it is for entertainment & conversation-provoking purposes only. Data may not be accurate. Check the current & historical data carefully at any company’s or provider’s website, particularly where a specific product, stock or fund is mentioned. Opinions are my own & I regularly get things wrong, so do your own due diligence & seek professional advice before investing your money.