We love our dividends in Canada. If dividends are so great, why not go for the even greater yields available with covered call ETFs? Maybe we can toss all our investments into covered call ETFs & retire early? That sounds great!

But does it work?

Maybe!

Every investing strategy has its fan base. But at the end of the day, it all comes down to how the numbers work for the individual investor. And covered call ETFs can work for some investors.

However, some features of covered call writing can be less appealing. The notion of covered call ETFs having lower volatility, for example, may be true. But volatility is a measure of an investment going up, as well as down. In general, covered calls will limit upside. If a growing stock is called away, you lose some of the upside. As investors, we don’t mind volatility if it means our investment is going up. We only fret when it goes down. Hand in hand with that is the idea that covered call writing offers some downside protection. You’ll notice the wording in the description of many funds says something like downside protection may be limited to the returns provided by the covered call premium. That’s marketing speak for “we can crash as hard as anything else but you’re at least getting that juicy covered call premium along the way”. Unfortunately, during times of growth or recovery, the capped upside often means that the growth of a covered call fund doesn’t match that of a fund holding the equities directly.

Let’s take a look at an example using only Canada’s big banks. The five largest banks in Canada all started paying dividends in the 1800s. That’s a little too far back to look at, but if you’d invested $100k in an equal-weight holding of the Big 6 banks back in January 2000, that portfolio would have grown to almost one & a half million dollars today! Investing in the large cap American or Canadian market index funds would only have returned under half a million over that time. Of course, nobody would risk going all in on just the Canadian banks. Right!?! But this kind of performance is why Canadians like their banks.

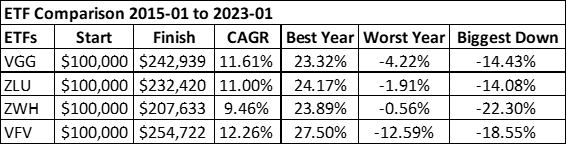

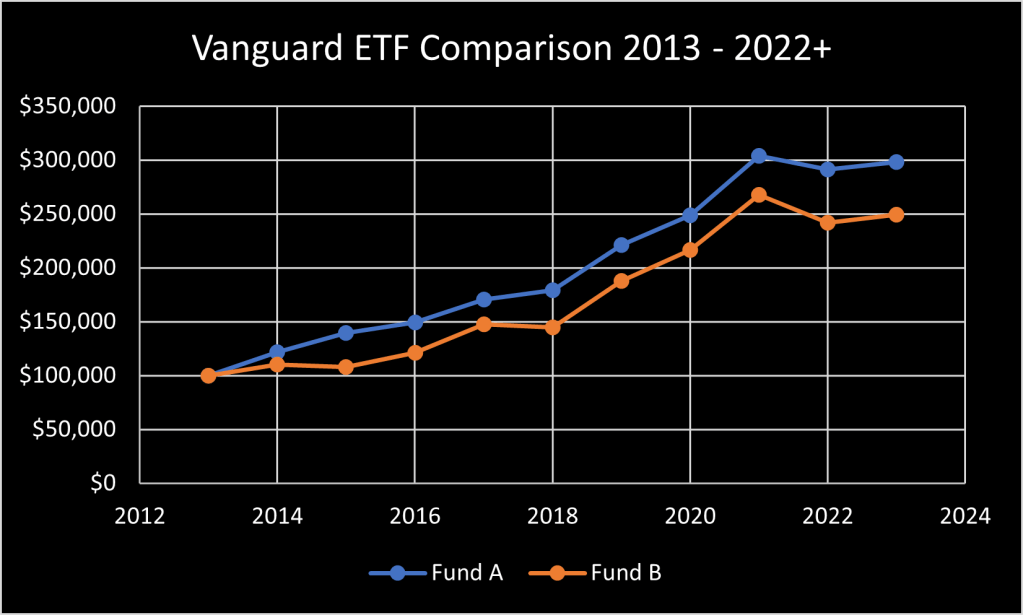

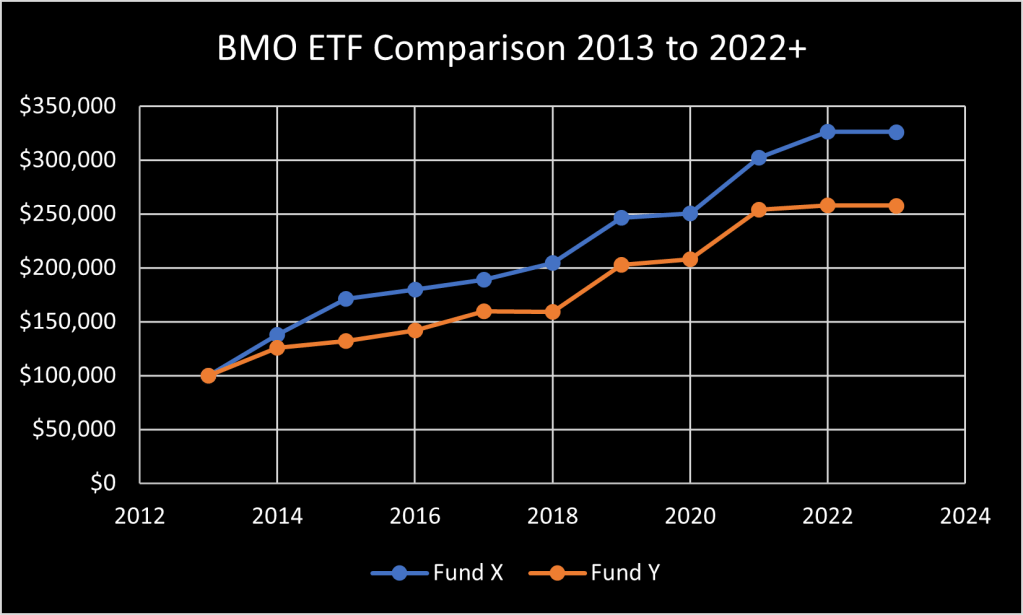

To compare the different investing strategies, I’ll use BMO’s ZEB & ZWB here. Both ETFs are designed to track the Solactive Equal Weight Canada Banks Index. And both funds are managed by BMO Global Asset Management, one of Canada’s largest ETF providers. ZEB just holds the banks. ZWB holds the same banks, but adds a covered call strategy to about 50% of the portfolio to generate a bigger income stream. These ETFs have a relatively short shared history, so we’re only looking at returns over an 11.5 year period up to the middle of this year here.

Accumulation

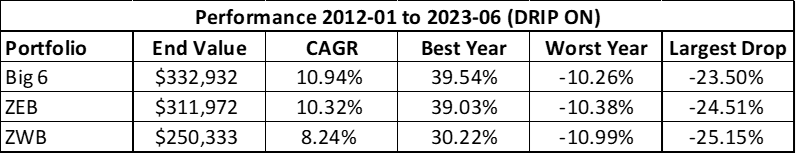

During the accumulation years, all dividends & distributions are reinvested, that’s the “DRIP ON” scenario in the table below. This shows the Total Return, with dividends reinvested, from a $100k investment directly in the bank stocks. And it compares that to the same $100k investment in ZEB & ZWB.

It’s probably no surprise that directly investing in the stocks produced the greatest return. The direct investment was rebalanced semi-annually, to match the index tracking guidelines used by the ETFs. While ZEB does all that work for us, the fees charged by the fund cause a little drag on the returns. Since covered call writing lops off some of the upside potential, it’s also not a surprise to see ZWB trailing the pack here. It’s CAGR & Best Year are poorer. But, it’s worth noting that it’s Worst Year is slightly worse than the other two. Fund managers do warn that covered call funds “may” provide downside protection. Sometimes, that might only be by the amount of the covered call premium. But it’s not a guarantee. Since ZWB had the biggest drop of the three, the covered call strategy didn’t provide much of a safety net during the covid crash of March 2020. It’s possible that longer periods of sideways, or slightly down, markets could have allowed ZWB to produce a better relative performance. All in all though, it’s a pretty good performance for all strategies. That’s the accumulation picture. Next we’ll look at what happens when we start spending the income.

Spending the Money

Things change when we retire & need to spend some of our savings every year. All sorts of new challenges come up. The ideal scenario for many retirees is to have their investments generate enough dividends & distributions for them to live on. No worries about having to sell shares in a down market, & so on. Here’s how these three investments deliver on the income front.

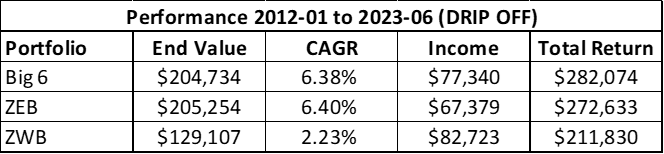

This table shows the picture for an investor who retired in 2012 & sucked out all the dividends & distributions for living expenses along the way. The holder of ZWB would have had more income over the 11.5 year period. Though overall, perhaps not the best value, since the value of the underlying portfolio didn’t grow as much as the other two. If an emergency situation forced the sale of some shares to raise capital, the other two approaches had far bigger portfolio values to draw from. Aside from the income, the positive thing about all these results is that the underlying assets continued to appreciate. All these ETFs show positive CAGR. And this is with all the dividends & distributions taken out. BMO’s limited covered call strategy, over this timeline, worked well. Any income investment that shows negative CAGR for the underlying assets (with DRIP off) might be an exposure for a retiree with a longer time horizon. The portfolio value would decline over time & that will have an impact on the income stream over the long haul too. There is one other exposure here & that is the impact of inflation. If we adjust the End Value of the portfolios in the above table, the Big 6 & ZEB are worth an inflation-adjusted amount of about $150k. The End Value of ZWH, in 2012 dollars, is just under $95k at the end. This isn’t quite accurate, as the inflation adjustment comes from US inflation data, not Canadian. But it still shows the importance of having a portfolio capable of staying ahead of inflation.

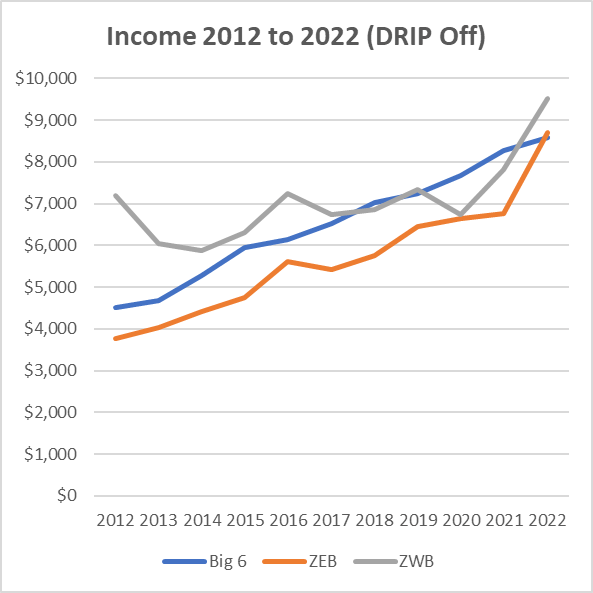

Here’s what the income streams look like for these investments …

While ZWB starts out with a far greater annual income than the other two options, it shows more variability than the other two. Variability of income from year to year can be an issue for some retirees. Perhaps more importantly, the other income streams are catching up as time goes by. Direct investing shows a more consistent upward trajectory, even without any additional investment or DRIP. And this is exactly what you’d hope for with a portfolio of dividend-growth stocks. The dividend growth is what grows the income stream. That can be very important for an investor with a longer expected time horizon in retirement. Early retirees should watch out for this.

The Canadian banks generally do well over time. For portfolio growth & for growth of income. But now it’s down to personal choice. Do you prefer to trade some long-term portfolio value for the bigger income stream of the covered call approach early in retirement? Or do you like the more consistent growth of the income stream that comes from a portfolio biased towards dividend growth? There are a lot of factors that go into individual decisions. For a young investor with a long time horizon, total return is probably going to be more important than the size of the income stream starting out. It might also be more important for an early retiree. Or for a healthy retiree with a longer life expectancy. Things like leaving an inheritance, planning for home care or a retirement home, & so on, all factor into the decision making process too. Regardless, the Canadian banks have been a pretty solid investment over time & they look good in all these scenarios. Of course, as you’ll find noted on every fund’s webpage … past performance is not indicative of future results! We can’t just assume an investment will continue to do well in the future because it’s done well in the past. The banks have been great performers historically. But not all stocks or funds perform as well as the banks did here. Be sure to compare your choices for total return & income growth. And not just the size of the yield!

If you want to learn more about all this from the ground up, I’d like to suggest that you check out Double Double Your Money, available at your local Amazon store.

Important – this is not investing, tax or legal advice, it is for entertainment & educational purposes only. Opinions are my own, so do your own due diligence & seek professional advice before investing your money.